|  |

You Have Choice

Your PCP serves as your healthcare “home” but sometimes you need more specialized care and the ECP plan offers you that flexibility. If specialist coverage is new to you or if you’re not sure when to see a specialist, talk to your doctor. You and your PCP may decide a health issue or symptom would benefit from more expect care and your PCP can direct you to see a physician who specializes in the related practices. Additionally, new with this plan, you have access to a 24-hour nurse line. Over the phone from a registered nurse, you can get fast medical advice from the comfort of your home or on the go. This free service can help guide you on where to go when you need care. Learn more about these benefits in your health plan materials.

In instances when you’re experiencing a health emergency, with the ECP plan you have options. Learn more about your health care and where to get it.

You Have Choice

Additionally, new with this plan, you have access to a 24-hour nurse line. Over the phone from a registered nurse, you can get fast medical advice from the comfort of your home or on the go. This free service can help guide you on where to go when you need care. Learn more about these benefits in your health plan materials.

In instances when you’re experiencing a health emergency, with the ECP plan you have options. Learn more about your health care and where to get it.

You Have Choice

Your PCP serves as your healthcare “home” but sometimes you need more specialized care and the ECP plan offers you that flexibility. If specialist coverage is new to you or if you’re not sure when to see a specialist, talk to your doctor. You and your PCP may decide a health issue or symptom would benefit from more expect care and your PCP can direct you to see a physician who specializes in the related practices.

Your PCP serves as your healthcare “home” but sometimes you need more specialized care and the ECP plan offers you that flexibility. If specialist coverage is new to you or if you’re not sure when to see a specialist, talk to your doctor. You and your PCP may decide a health issue or symptom would benefit from more expect care and your PCP can direct you to see a physician who specializes in the related practices.

Additionally, new with this plan, you have access to a 24-hour nurse line. Over the phone from a registered nurse, you can get fast medical advice from the comfort of your home or on the go. This free service can help guide you on where to go when you need care. Learn more about these benefits in your health plan materials.

In instances when you’re experiencing a health emergency, with the ECP plan you have options. Learn more about your health care and where to get it.

Forms | UBR References | Important Information | UBR/Retiree Chair Newsletters |

Personal Health InformationTrust PHI Authorization Instructions and Form BCBS PHI Authorization Form BCBS Psychotherapy Authorization Form BCBS Revocation Form (to revoke an authorization) Express Scripts Direct Claim FormsDirect Claim Form - Non-Medicare Members Direct Claim Form - Medicare Members Retiree MeetingsRetiree Meeting Presentation/Attendance Request Link | 2018 Guide for All Autos Member Inquiry Submission Form Aetna Microsite | What You Need to Know About Medicare Durable Medical Equipment Changes About the Trust |

Click here to access Medical Benefit Details of a specific plan.

More Benefits

In addition to unlimited access to PCP and specialist physician office visits at a flat dollar copay, this plan will feature personalized, convenient resources to assist you in navigating the health care system. You will have access to a personal, dedicated health guide who can help you find hospitals and doctors, answer questions about what’s covered under the plan, assist you with any provider billing questions, as well as connect you to a supporting team of clinical staff, care managers, and new specialized programs.

| Column 2 |  |

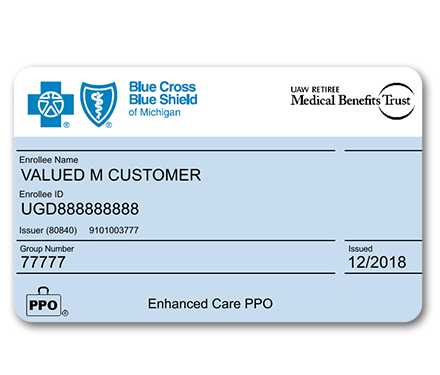

| Enhanced Care PPO (ECP) Plan Enrollment for Non-Medicare Members Materials |  | 2019 Medicare Advantage PPO (MA PPO) Plan Information |

| Enhanced Care PPO (ECP) Plan Enrollment for Non-Medicare Members MaterialsECP Targeted Mailing Matrix2018 BCBS In-Person Information Meeting Schedule Enhanced Care PPO (ECP) Member Information Page |  |