Non-Medicare Benefits & Plans

Non-Medicare Member Benefits

Watch this video to learn more about how your UAW Retiree Medical Benefits Trust coverage works when you are not enrolled in Medicare.

Primary Plan: ECP

The Enhanced Care PPO (ECP) plan is the primary plan for non-Medicare Trust members. This nationwide health plan provides unlimited primary care physician (PCP) and specialist physician office visits at a flat dollar copay, as well as other helpful programs. Offered through Blue Cross Blue Shield (BCBS), the ECP plan offers more benefits than other plan options while providing access to a national network of PPO doctors and hospitals.

In addition, this plan features personalized, convenient resources to help you navigate the health care system. You have access to a personal, dedicated health guide who can help you find hospitals and doctors, answer questions about what’s covered under the plan, assist with provider billing questions, as well as connect you to a supporting team of clinical staff, care managers, and specialized programs.

Learn More

For coverage details, participating providers, and more, contact BCBS Health Guide at 866-507-2850.

Plan Types

ECP | HMO |

Enhanced Care PPO | Health Maintenance Organization |

EligibilityNon-Medicare members | EligibilityNon-Medicare (and Medicare members) living in regions within these states: California, Colorado, Georgia, Maryland, Michigan, Oregon, Washington D.C., Washington (state), and Virginia where an HMO is offered. |

About the PlanThis is the primary plan for Non-Medicare members. Based on a nationwide network of providers, the ECP plan allows services to be performed both in-network and out-of-network. | About the PlanHMO plans are offered in limited areas where they are able to be competitive with the Enhanced Care PPO (ECP) plan. HMO plans are based on a regional network of providers and do not offer out-of-network benefits (emergency services may be covered). |

CostMay have copays, deductibles, coinsurance and out-of-pocket maximums—refer to Benefit Highlights. | Cost

May have copays, deductibles, and out-of-pocket maximums—refer to Benefit Highlights. |

More InfoRefer to Benefit Highlights or contact BCBS at 866-507-2850. | More InfoRefer to the evidence of coverage or contact your plan carrier at the number on the back of your medical ID card. |

Cost Share

Before reviewing more details on your available plan options, it’s important to understand all Trust provided plans have copay and cost share elements. As a member of the Trust, you are responsible for paying certain health care coverage costs including a monthly contribution, annual deductible, coinsurance, copayment and annual out-of-pocket maximum. Understanding how these work will help you know when they apply and how much you will have to pay for care.

Copay elements are fixed dollar amounts for services such as Primary Care Physician (PCP) office visits, specialist visits, urgent care visits and emergency room visits.

Cost share elements can include deductibles, coinsurance and out-of-pocket maximums.

Benefit Materials for Download

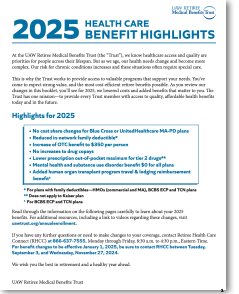

2025Benefit Highlights | 2023Summary Plan Description | 2025Health CareBenefit Summary |

|  |  |

| All Members | All Members | All Members |

| Learn about your 2025 cost share and benefit coverage updates. An addendum to the SPD, Benefit Highlights includes year-to-year changes in cost share and benefit coverage, mailed every fall. | A summary of the Plan Document. This is written to be more easily understood and is typically updated and mailed to Trust members every five years (the current version was published in 2023). | Changes made in the years between the Summary Plan Description (SPD) and the current Benefit Highlights are detailed in the Health Care Benefits Summary. |